Transaction Fee

07/02/2024

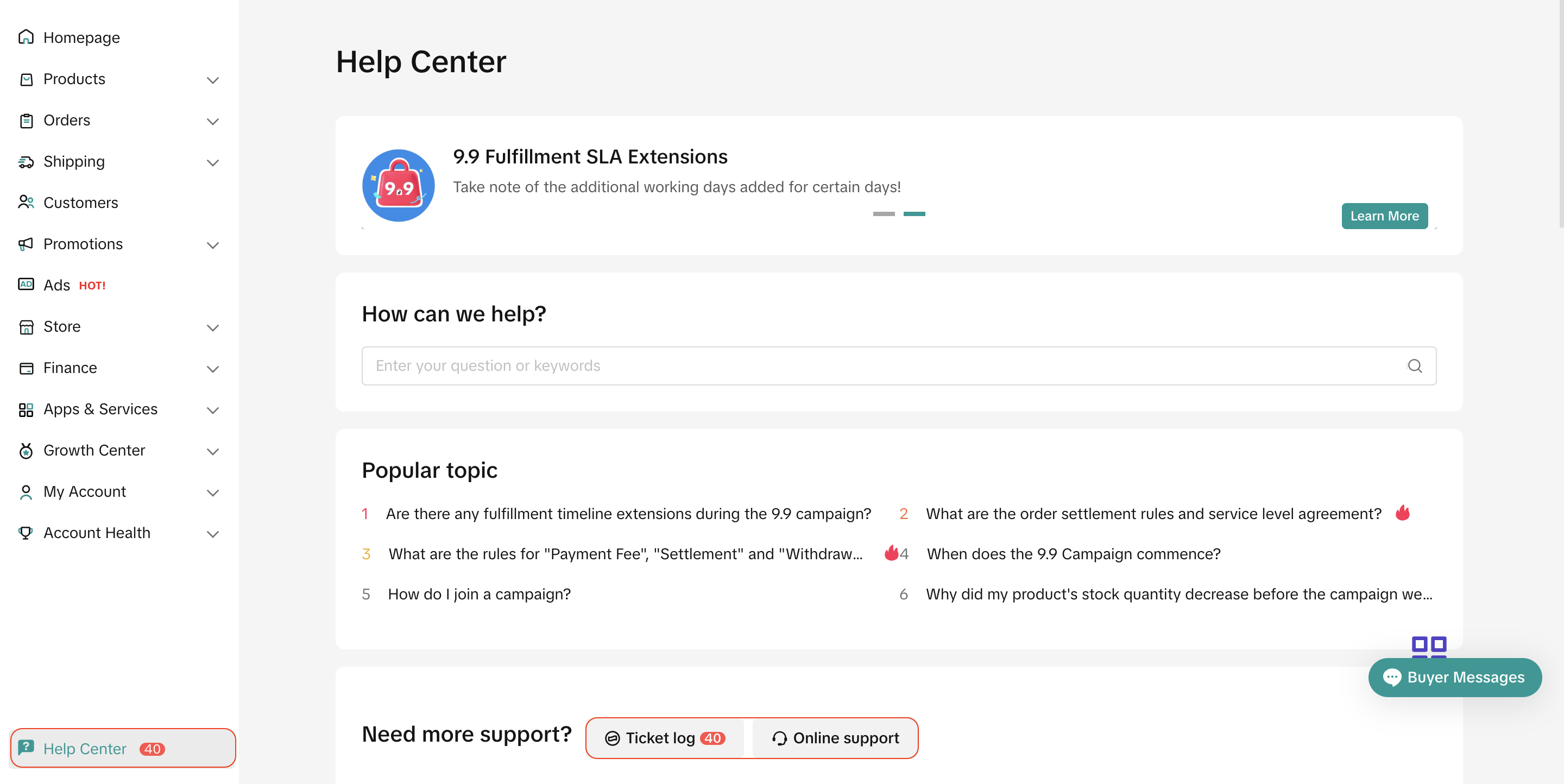

*Last update: 10:00, 1st of July, 2024, Vietnam time (GMT+7)*Important update: Starting from 00:00, 17th July, 2024, Vietnam time (GMT+7), TikTok Shop increased the Transaction Fee rate from 4.0% to 5.0% on buyer's total payment for all successful orders.

The Transaction Fee Rate is as follows:

Important: the Transaction Fee rate is inclusive of VN taxes. If you are a tax registered organisation in Vietnam and your Tax Code has been provided to and verified by TikTok, we will only collect the amount exclusive of taxes. Learn more here.

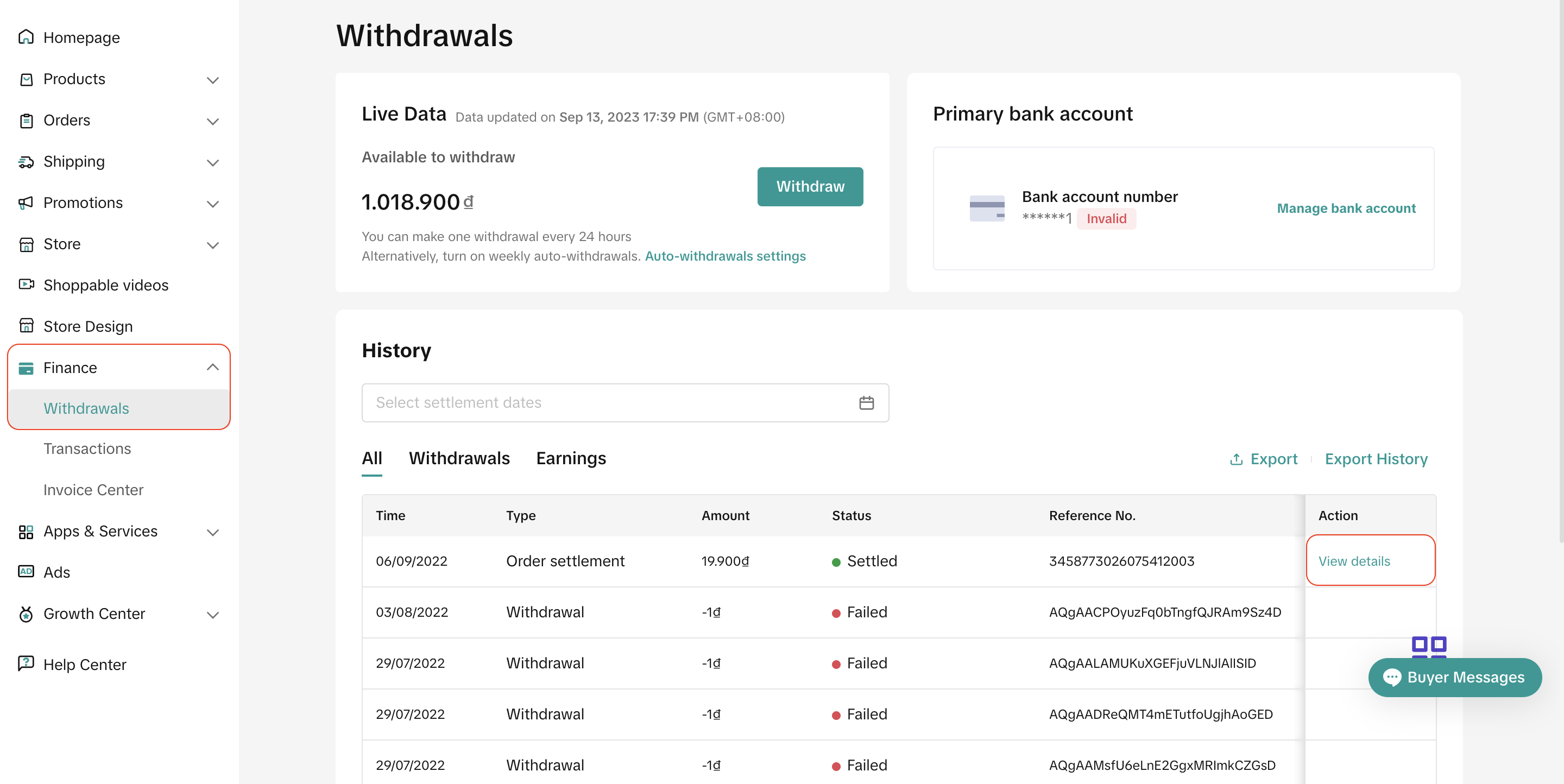

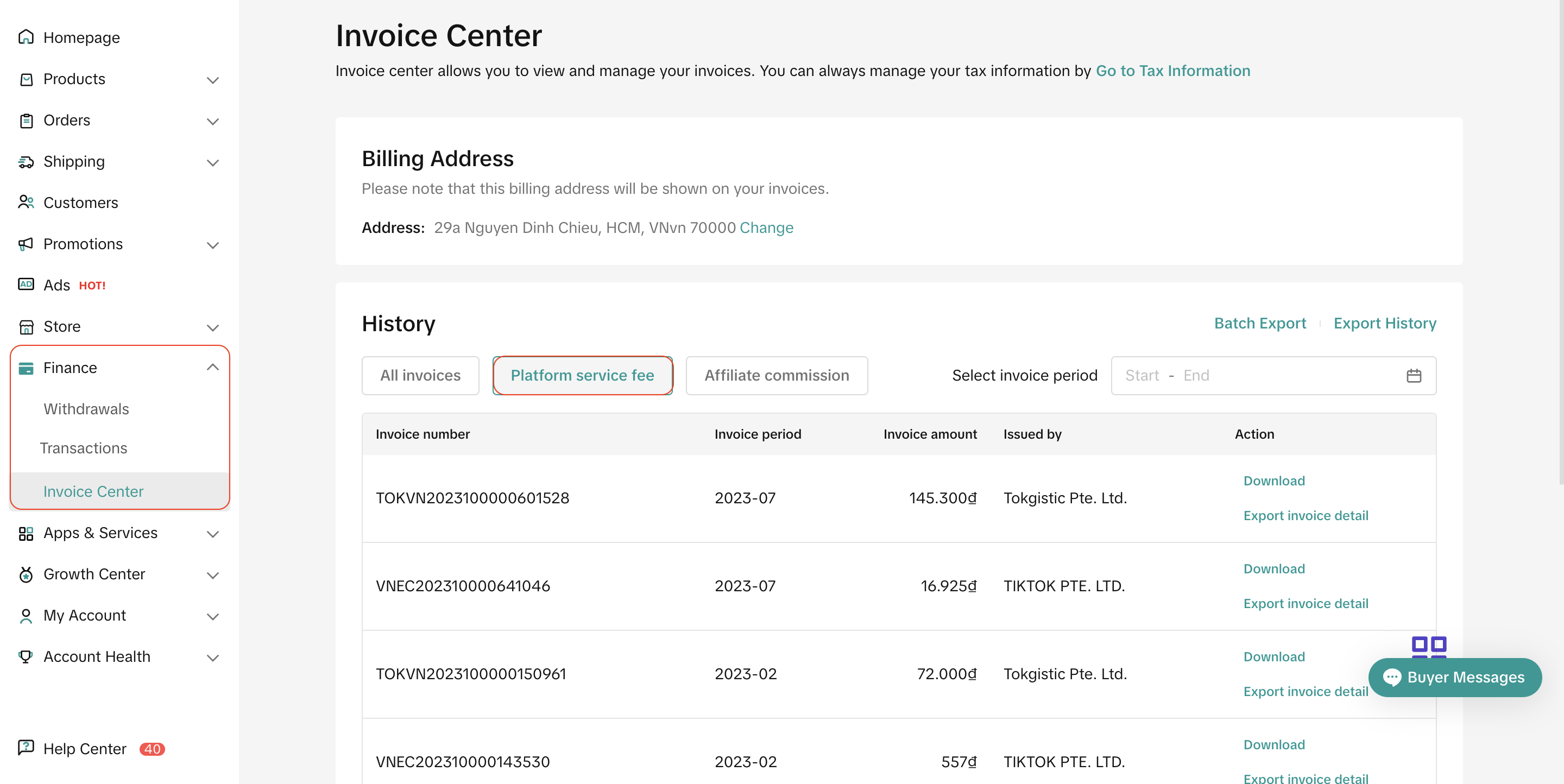

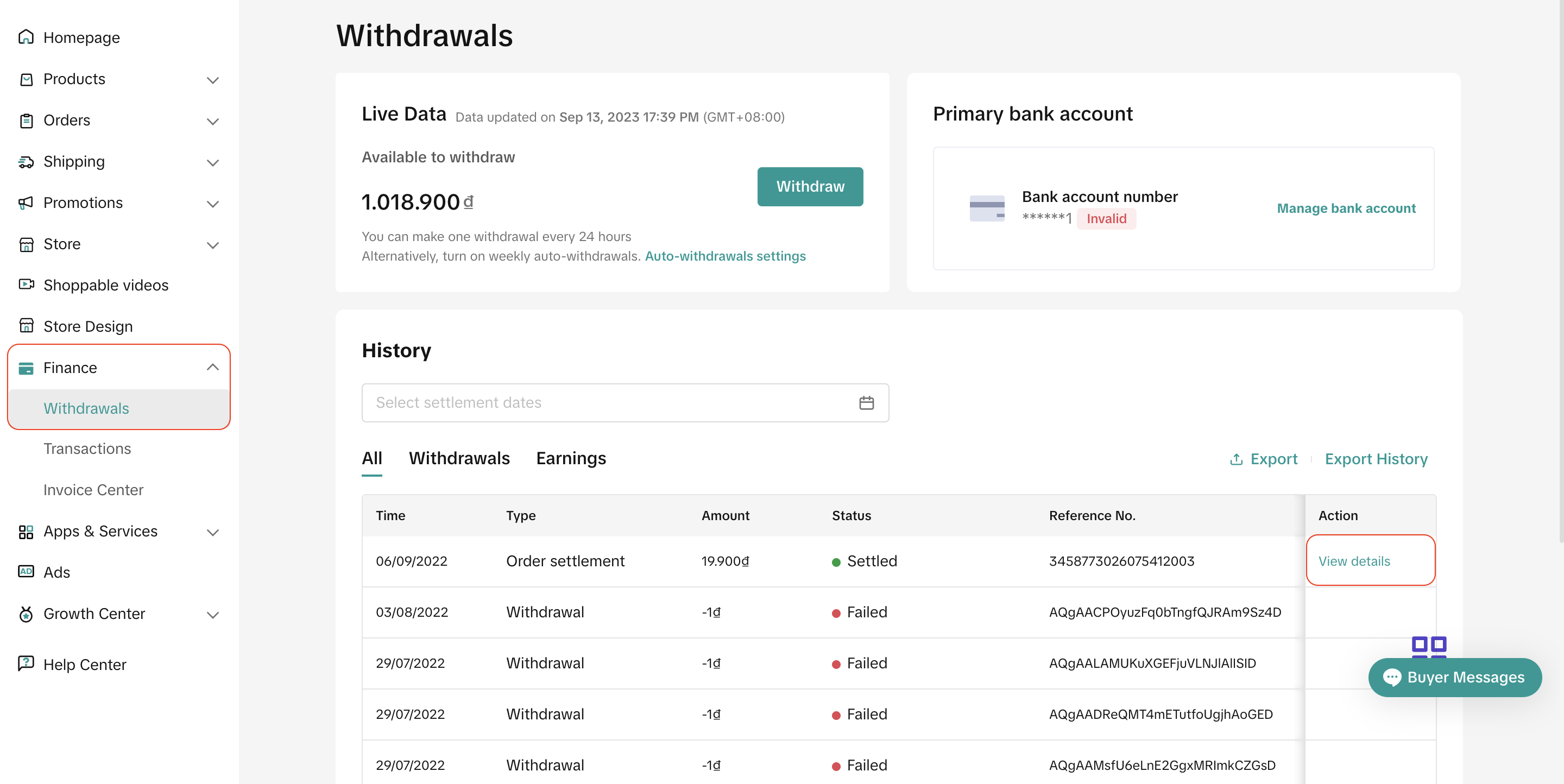

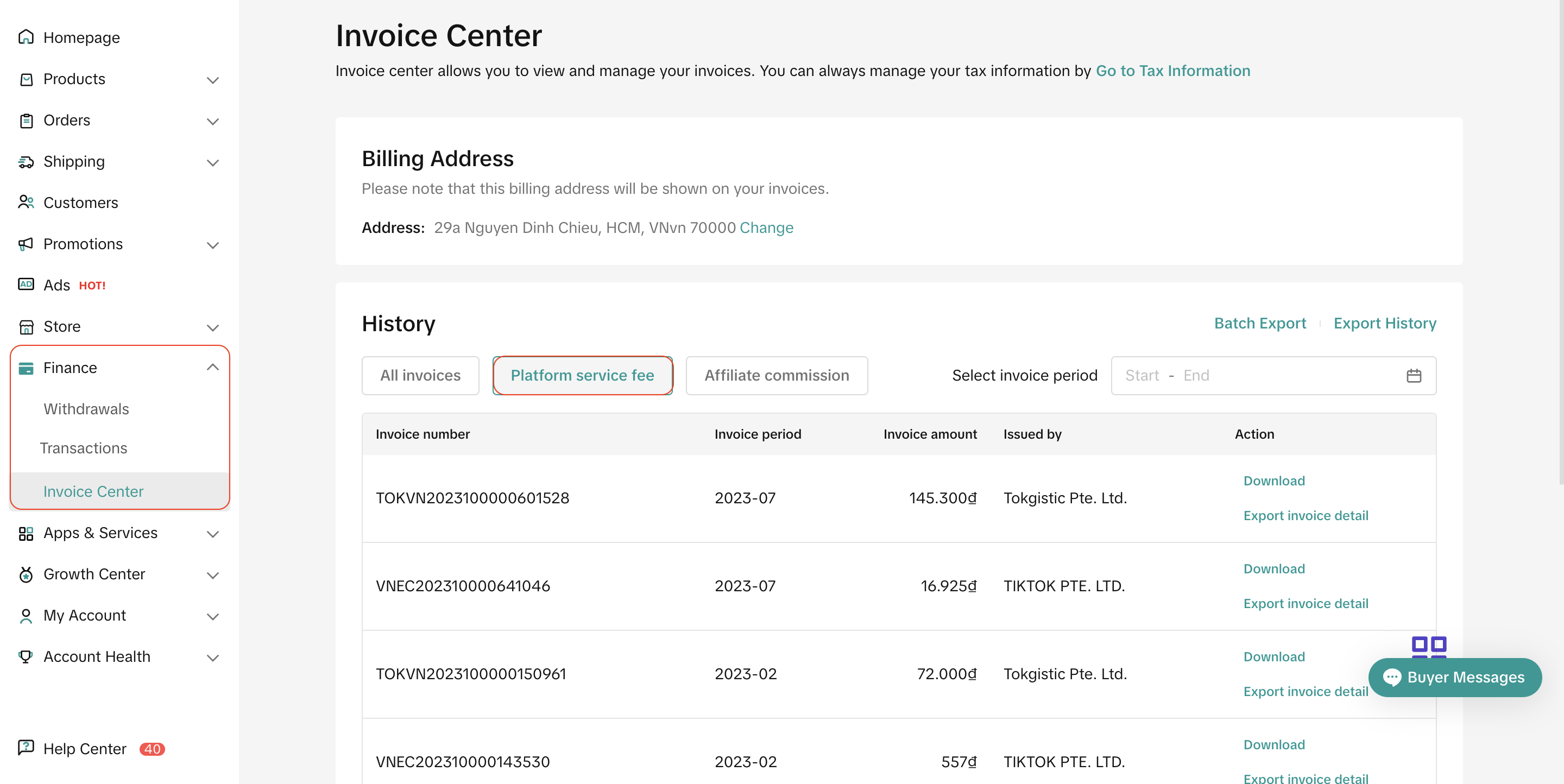

Note: The above screenshots are just for reference. Actual interface display, amount and rates might be different.

Note: The above screenshots are just for reference. Actual interface display, amount and rates might be different. Note: The above screenshots are just for reference. Actual interface display, amount and rates might be different.

Note: The above screenshots are just for reference. Actual interface display, amount and rates might be different.

What is Transaction Fee?

After an order is successfully delivered to buyers, TikTok Shop will automatically deduct a fee from the final payout settlement. This amount is the Transaction Fee, and is charged to all sellers for processing successful orders in TikTok Shop.The Transaction Fee Rate is as follows:

Time | Amount |

| For orders created before 00:00, 17th July, 2024, Vietnam time (GMT+7) | 4% of total customer payment, after refund. |

| For orders created from 00:00, 17th July, 2024, Vietnam time (GMT+7) | 5% of total customer payment, after refund. |

How is the Transaction Fee calculated?

Formula

Transaction Fee = (Customer Payment - Customer Order Refund) * fee rate %Example (Successfully Placed Order)

Item: Grey Shoe

| |

| Item Price | 100,000 ₫ |

| (-) Seller Discount | 5,000 ₫ |

| (+) Customer Shipping Fee | 5,900 ₫ |

| Customer Payment | 100,900 ₫ |

| (X) Transaction Fee Rate | 5.00% |

| Transaction Fee | 5,045₫ |

Example (Successfully Refunded Order)

| |

| Item Price | 100,000 ₫ |

| (-) Seller Discount | 5,000 ₫ |

| (+) Customer Shipping Fee | 5,900 ₫ |

| Customer Payment | 100,900 ₫ |

| (-) Customer Order Refund | 40,000₫ |

| (X) Transaction Fee Rate | 5.00% |

| Transaction Fee | 3,045 ₫ |

FAQs

- Who will be charged the Transaction Fee?

- All sellers on TikTok Shop in Vietnam.

- How will I be charged the Transaction Fee?

- The Transaction Fee charges will be deducted directly from the order settlement. Only paid orders that have been successfully delivered to and accepted by the buyer are considered valid. Cancelled or fully returned or refunded orders are not considered valid orders.

- Where can I check the details of the Transaction Fee amount charged for my order?

- For orders that have yet to be settled, you may see their Transaction Fee in TikTok Shop Seller Center > Finance > Transactions > To settle > View Details

Note: The above screenshots are just for reference. Actual interface display, amount and rates might be different.

Note: The above screenshots are just for reference. Actual interface display, amount and rates might be different.- For orders that have been settled, you may see their Transaction Fee in TikTok Shop Seller Center > Finance > Transactions > Settled > View Details

Note: The above screenshots are just for reference. Actual interface display, amount and rates might be different.

Note: The above screenshots are just for reference. Actual interface display, amount and rates might be different.- What does the refund process look like?

- If the entire order is returned, the full transaction fee will be refunded to the seller. If part of the order is refunded, the transaction fee charged on the refunded item (s) will be refunded to the seller.

- The final amount for the Transaction Fee for each of my successful orders is slightly different from what I have calculated using the formula: Transaction Fee* = (Customer Payment - Customer Order Refund) * fee rate

- Take note that if you are a tax registered organisation in Vietnam and you have provided your Tax Code to TikTok.

- Once your Tax Code has been verified, the Transaction Fee that TikTok collects and shows on invoice will be net of VN Taxes. This means that it excludes VN taxes (VAT & CIT).

- As a tax registered organisation, you're obliged to remit and report VN taxes on behalf of TikTok.

- For more information, kindly visit our feature guide here to understand the tax calculation illustration in Vietnam.

- Since this is a chargeable fee, will I receive an invoice describing the full Transaction Fee amount TikTok Shop has charged me for the month?

- Yes, you will receive an invoice the following month for the previous month's billing period. You may visit Finance > Invoice Center > Platform Service Fee to download the invoice.

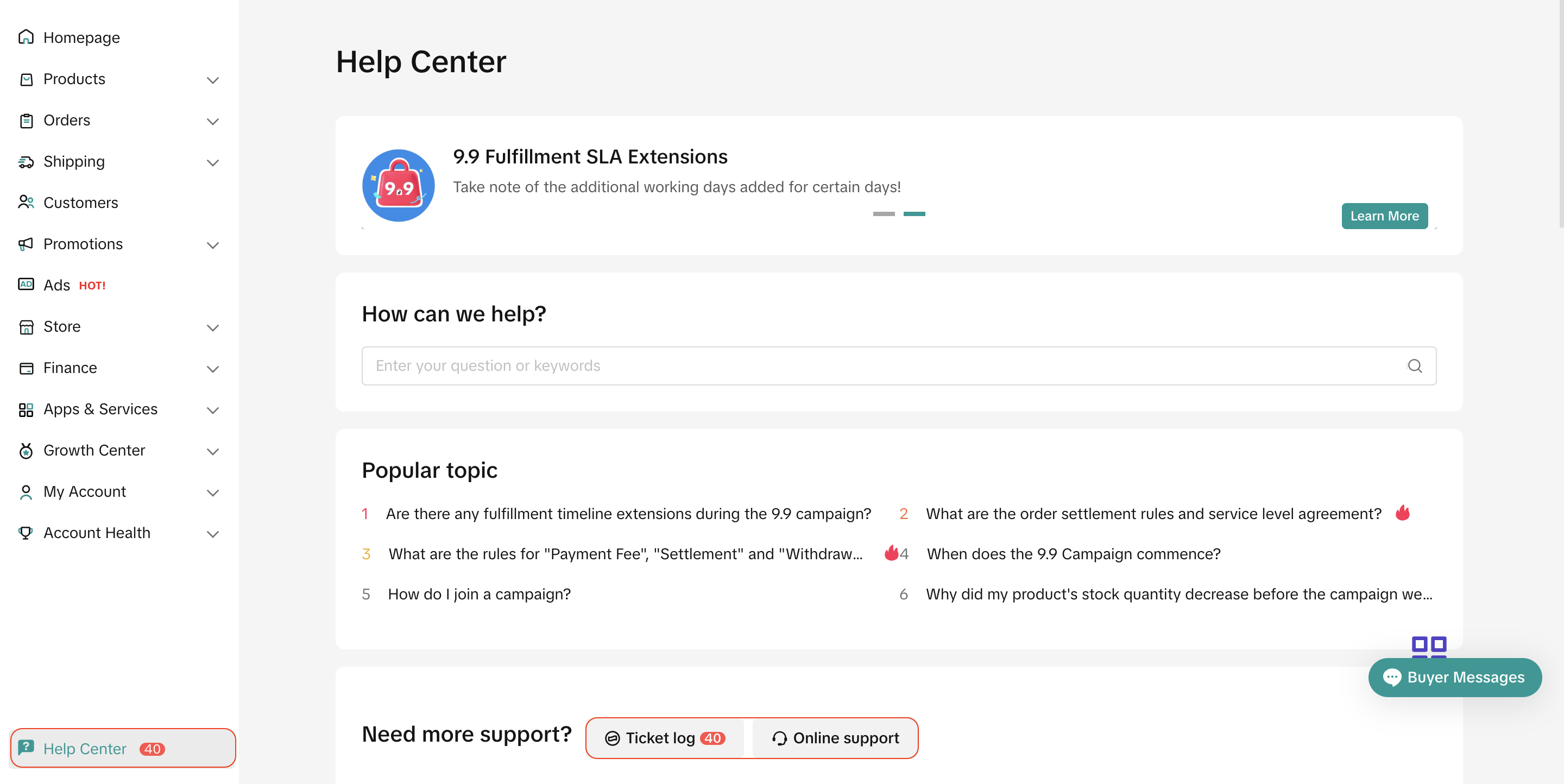

- What should I do if I have some inquiries in regards to the Transaction Fee?

- You may reach out to our support team in TikTok Shop Seller Center > Help Center.

- Or you may also file an inquiry ticket at 'Ticket log' or please feel free to reach out and speak to our support representative via 'Online Support