Platform Commission Fee

11/27/2025

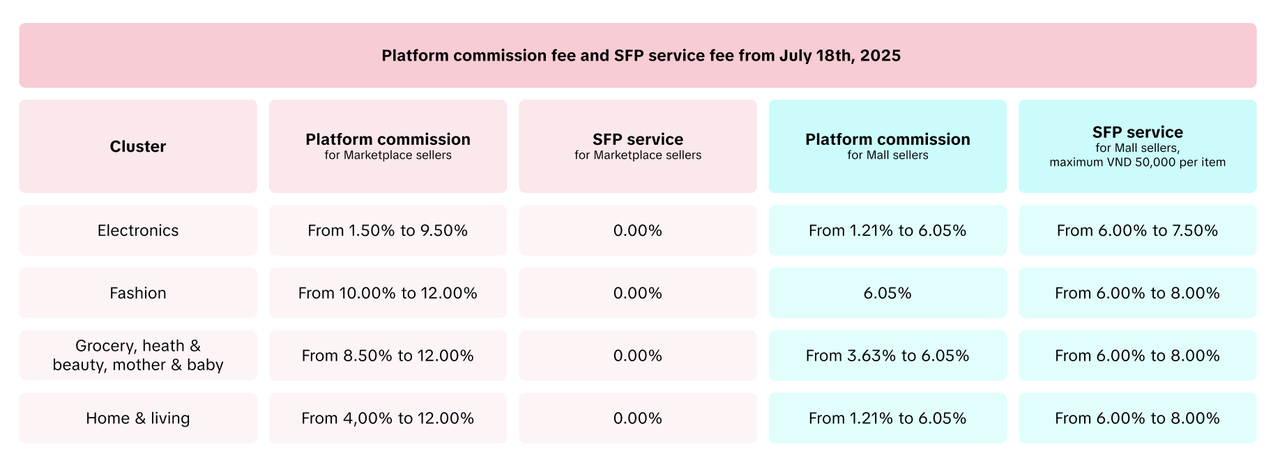

With our commitment to continuously improve all users' experience, starting 27th October, 2025 Vietnam time (GMT+7), we will adjust certain benefit and commission commission fee schemes:

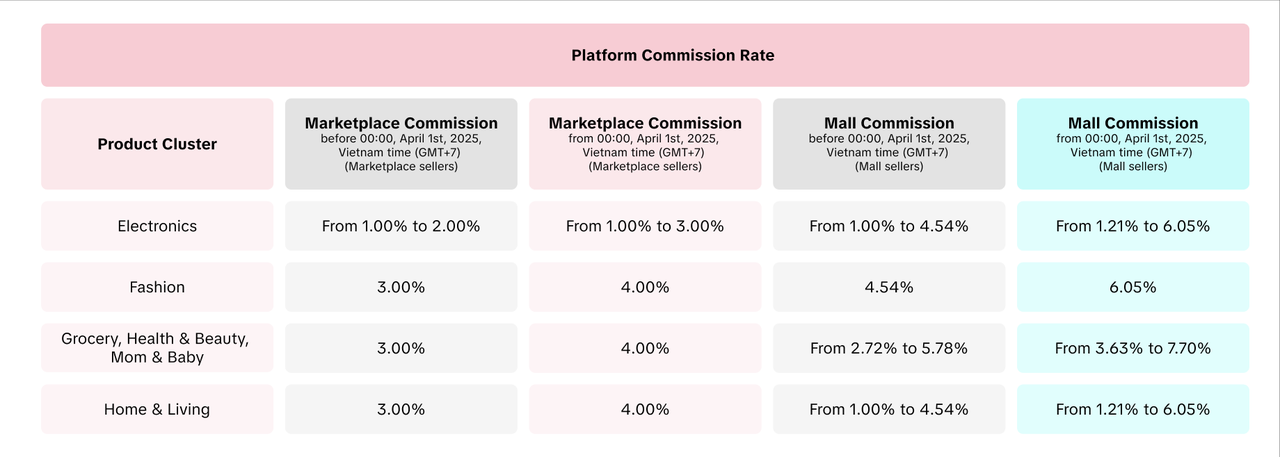

The Platform Commission Fee is different for Marketplace Sellers and Mall Sellers.

Please see the file attached for the fee rate* by product sub-category.

Please see the file attached for the fee rate* by product sub-category.

The formula is as follows:

Platform Commission Fee = (Item Price - Seller Discount) * Fee rate

Note: The above screenshots are just mock-up examples for reference purposes. Actual interface display and rates might be different.

Note: The above screenshots are just mock-up examples for reference purposes. Actual interface display and rates might be different. Note: The above screenshots are just mock-up examples for reference purposes. Actual interface display and rates might be different.

Note: The above screenshots are just mock-up examples for reference purposes. Actual interface display and rates might be different.

- For Mall sellers: Commission Fee adjustment and SFP service fee discontinuation.

- For Marketplace sellers: Commission Fee adjustment (decreases for grocery, health & beauty, mother & baby, and home & living; and increase/decrease depending on categories for electronics and fashion).

What is Platform Commission Fee

Platform Commission Fee is the amount that the platform charges to all sellers in Vietnam based on the category of a product for successful orders.The Platform Commission Fee is different for Marketplace Sellers and Mall Sellers.

How much is the Platform Commission Fee?

Platform Commission Fee rate by product cluster

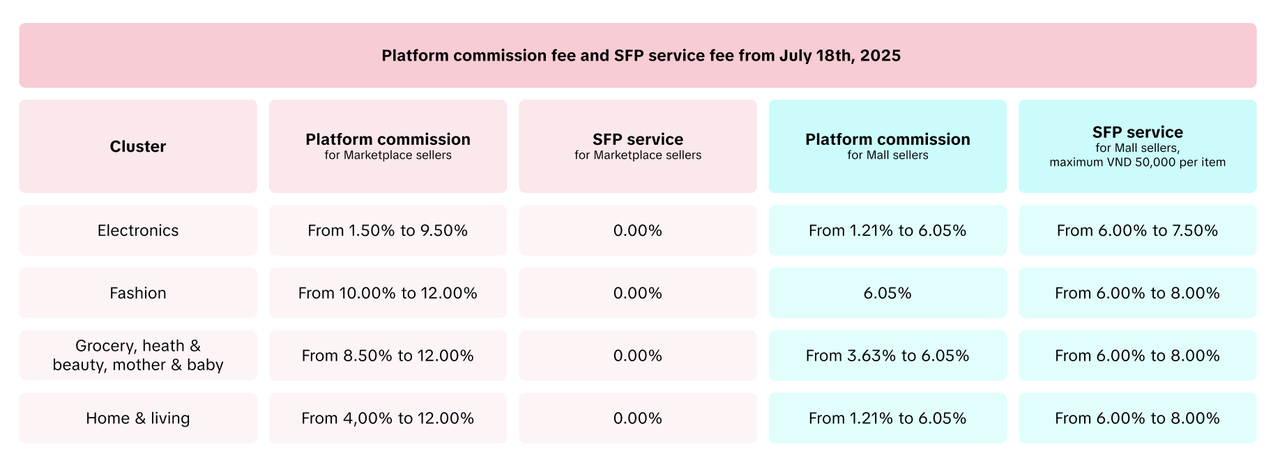

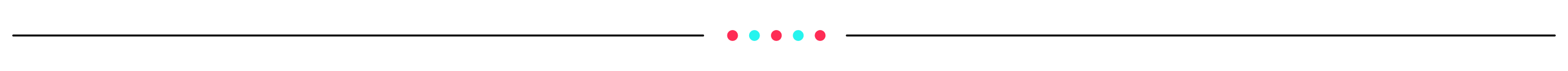

The Platform Commission Fee Rate* by product cluster is:- Before 18th July, 2025:

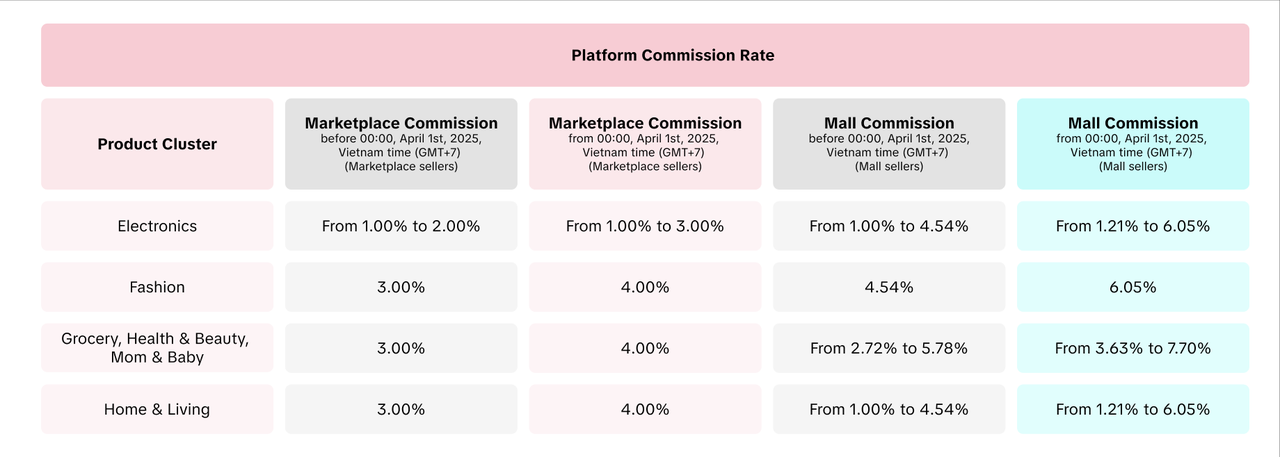

- From 18th July, 2025, with the SFP opening to all Marketplace sellers:

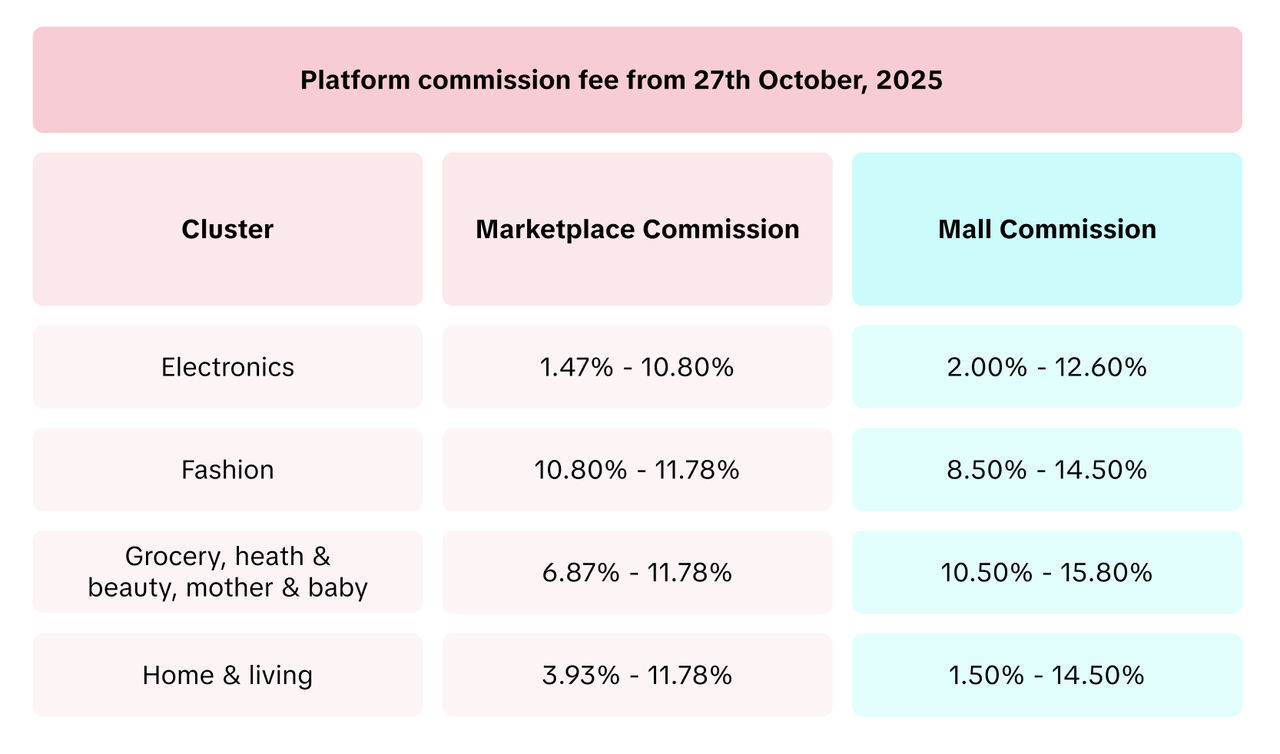

- From 27th October, 2025, with SFP opening to all sellers:

Please see the file attached for the fee rate* by product sub-category.

Please see the file attached for the fee rate* by product sub-category.- Before 18th July, 2025:

- From 18th July, 2025:

- From 27th October, 2025:

- The Platform Commission Fee is inclusive of VN taxes. If you are a tax registered organisation in Vietnam and your Tax Code has been provided to and verified by TikTok Shop, TikTok Shop will only collect the amount exclusive of taxes. For more information, kindly visit our feature guide here to understand the tax calculation illustration in Vietnam.

- Any level 3 categories outside the full fee rate table will be subject to a default rate.

- Before 27th October 2025, the default rate is 12.00% for Marketplace sellers and 6.05% for Mall sellers.

- From 27th October 2025, the default rate is 10.80% for Marketplace sellers and 13.70% for Mall sellers.

How to calculate Platform Commission Fee by product category?

Formula

The platform commission fee is calculated from the item price, minus any seller discounts. Shipping fees and platform discounts are not included as part of the calculation of the platform commission fee.The formula is as follows:

Platform Commission Fee = (Item Price - Seller Discount) * Fee rate

Calculation Example

- Example 1 - Marketplace seller:

| |

| Original item price | VND 1 000 000 |

| (-) Seller discount | VND 100 000 |

| Subtotal after discount | VND 900 000 |

Marketplace Commission rate | 11.78% |

| Platform Commission Fee= Subtotal after discount x Commission rate | VND 106 020 |

- Example 2 - Mall Sellers

| ||

Guitar | Purifier | |

| Original item price | VND 1 000 000 | VND 2 000 000 |

| (-) Seller discount | VND 100 000 | VND 0 |

| Subtotal after discount | VND 900 000 | VND 2 000 000 |

Commission rate | 9.40% | 6.87% |

| Platform Commission Fee= Subtotal after discount x Commission rate | VND 84 600 | VND 137 400 |

Total Platform Commission Fee & SFP service fee | VND 222 000 | |

FAQ

- Who will be charged the platform commission fee?

- All sellers on TikTok Shop in Vietnam are charged a platform commission fee. The fee rate is different for Marketplace sellers and Mall sellers.

- Note: All new Local-to-Local sellers 1/7/2025 - 31/07/2025 who have completed the Seller Task "Earn transaction waiver for 60 days after joining Voucher Extra Program (VXP) for 30 days!" will enjoy a 0% Transaction fee (for Mall and non Mall sellers) for 60 days. You can find this task in My Missions and read more here.

- What is a "successful order"?

- Successful orders are paid orders that have been successfully delivered to and accepted by the buyer. Cancelled or fully returned or refunded orders are not considered successful orders.

- How will sellers be charged the platform commission fee?

- The Platform Commission Fee charges will be deducted directly from the order settlement.

- Is the Platform Commission Fee inclusive of tax?

- The Platform Commission Fee is inclusive of VN taxes. If you are a tax registered organisation in Vietnam and your Tax Code has been provided to and verified by TikTok Shop, TikTok Shop will only collect the amount exclusive of taxes. For more information, kindly visit our feature guide here to understand the tax calculation illustration in Vietnam.

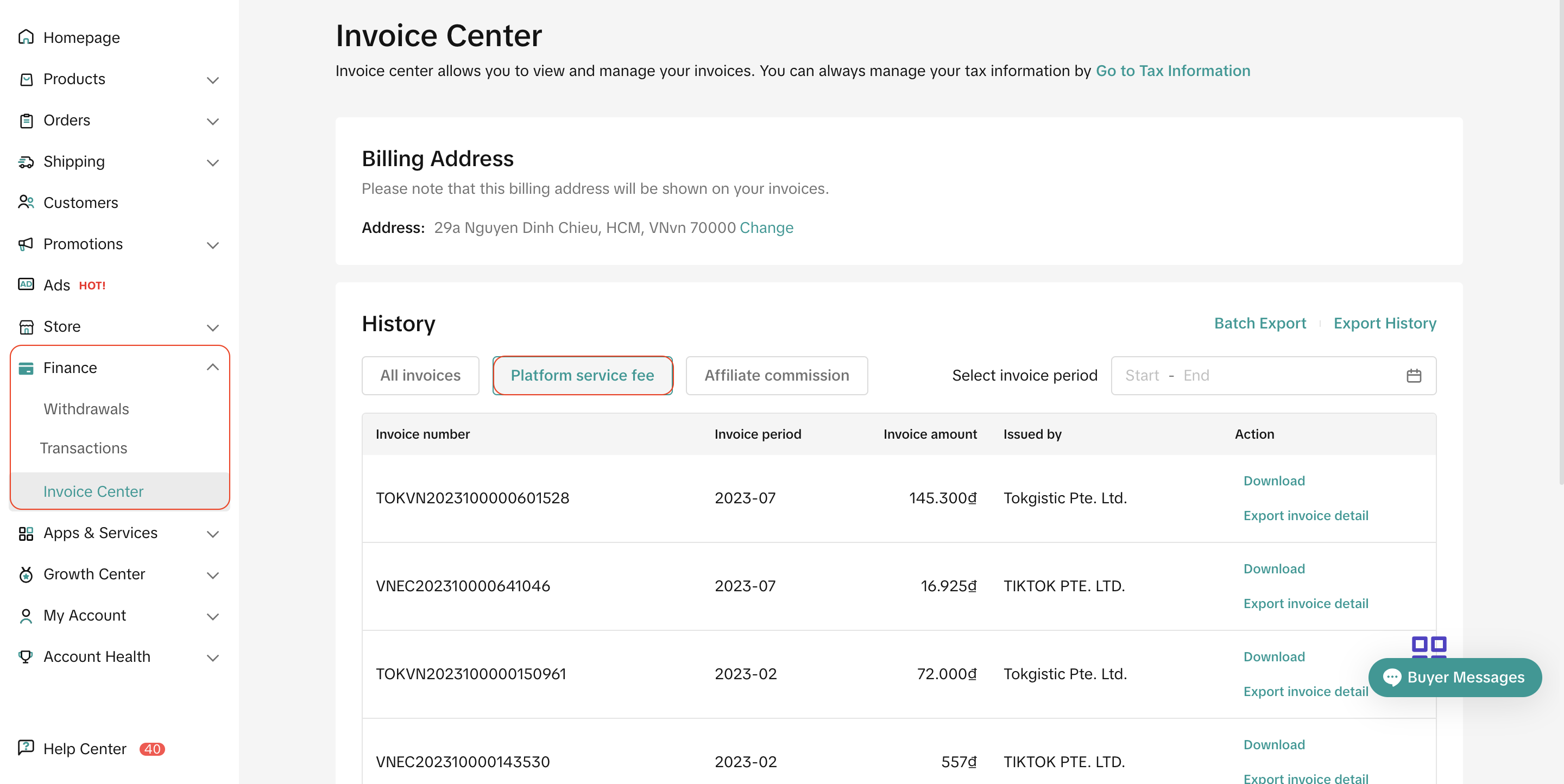

- Where can sellers check the details of the commission amount?

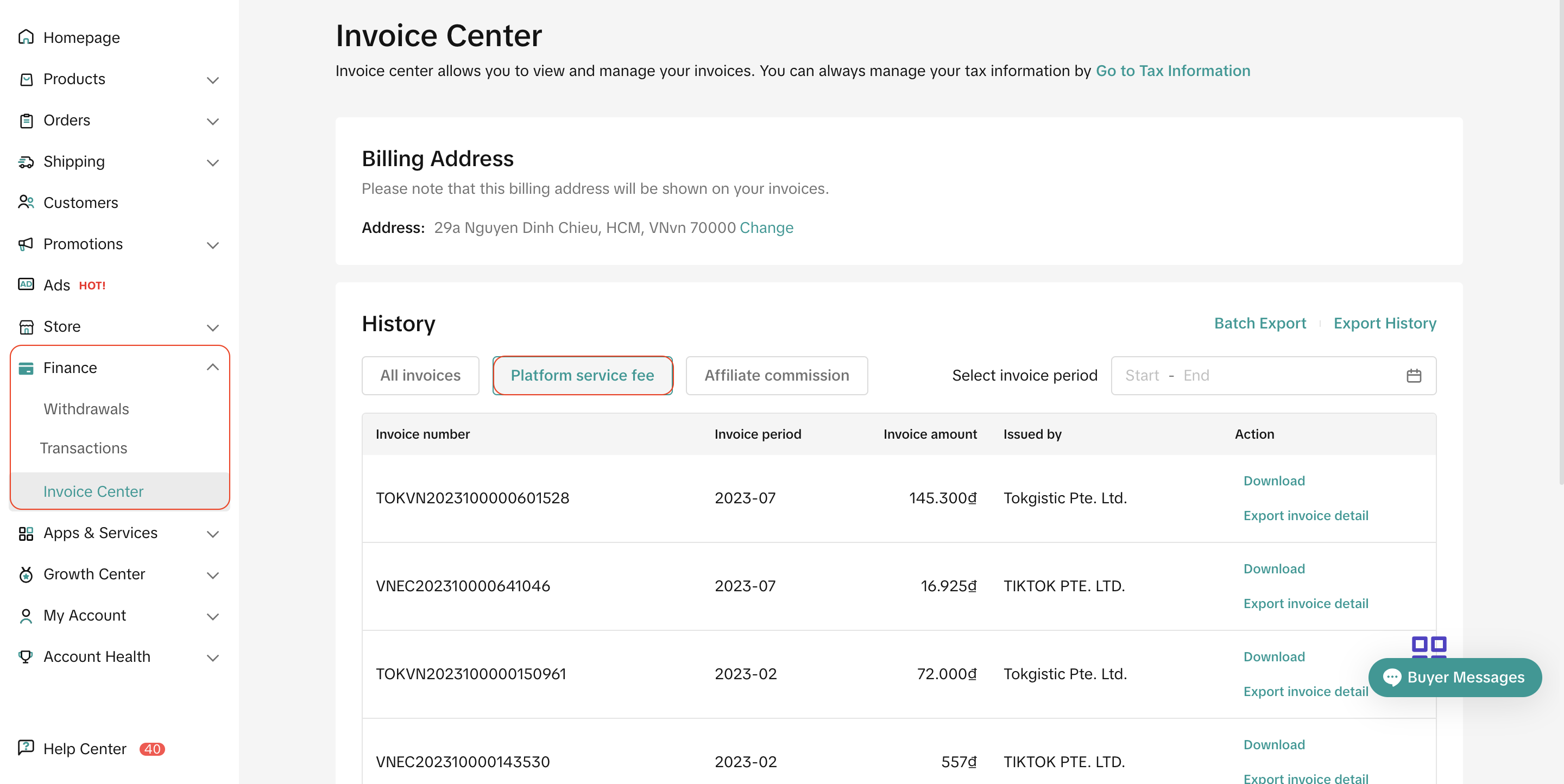

- For orders that have yet to be settled, you may see them in Seller Center > Finance > Transactions > To settle > View Details > Estimated Settlement Details and check "Platform Commission".

Note: The above screenshots are just mock-up examples for reference purposes. Actual interface display and rates might be different.

Note: The above screenshots are just mock-up examples for reference purposes. Actual interface display and rates might be different.- For orders that have been settled, you may see them in Seller Center > Finance > Transactions > Settled > View Details > Earning Details and check "Platform Commission".

Note: The above screenshots are just mock-up examples for reference purposes. Actual interface display and rates might be different.

Note: The above screenshots are just mock-up examples for reference purposes. Actual interface display and rates might be different.- What does the refund process look like?

- If the entire order is returned, the full commission fee will be refunded to the seller. If part of the order is refunded, the commission fee charged on the refunded item (s) will be refunded to the seller.

- Where is platform discount in the calculation of the Platform Commission Fee?

- The calculation of the Platform Commission Fee does not consider any platform-sponsored discount.

- Since this is a chargeable fee, will sellers receive an invoice describing the full Platform Commission Fee amount that the platform has charged for the month?

- Yes, sellers will receive an invoice the following month for the previous month's billing period. Sellers may visit Finance > Invoice Center > Platform Service Fee to download the invoice.

Note: The above screenshots are just mock-up examples for reference purposes. Actual interface display and rates might be different.

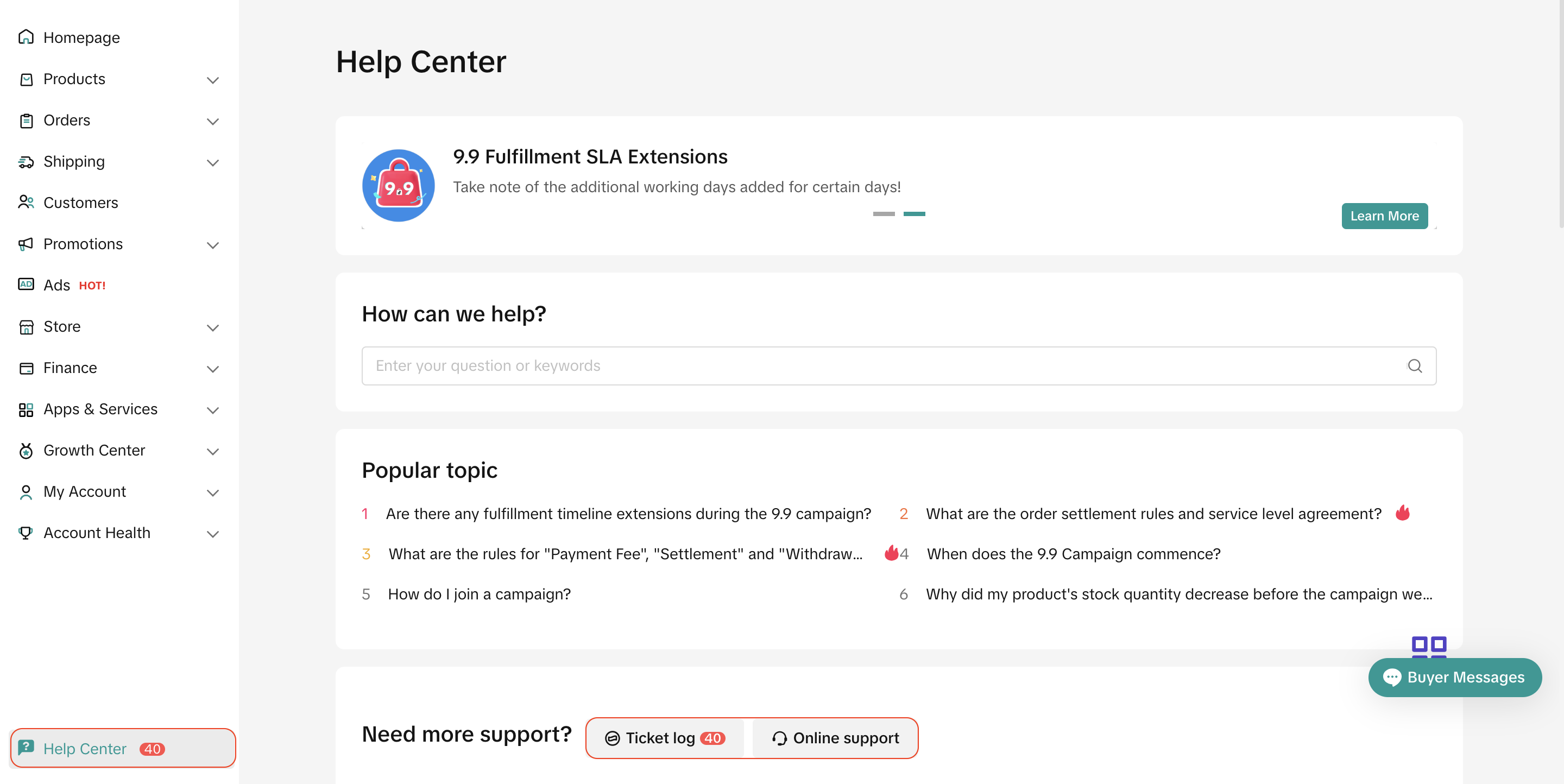

- What should sellers do if they have inquiries in regards to the Platform Commission Fee?

- Sellers may reach out to the support team in Seller Center > Help Center.

- Or sellers may also file an inquiry ticket at 'Ticket log' or please feel free to reach out and speak to support representative via 'Online Support'