Credit Card Installment Payment

06/25/2024

Starting from the 23rd of May, 2024, to facilitate more purchase scenarios and encourage higher conversion rates for high-value purchases, TikTok Shop is partnering with licensed banks and financial service providers to provide customers with the option to split their credit card payments into monthly installments.

*Note: this feature is not yet opened to all sellers.

Banks that support CC IPP on TikTok Shop are: Shinhan bank, Standard Chartered, Techcombank, HSBC, ACB, TPBank, BIDV, Eximbank, MSB, Nam A Bank, OCB, SCB, SeABank, SHB, HDBank, PVcomBank.

Customers can see CC IPP and the selected tenures when their order reaches a minimum value of VND 3.000.000 and there is only one product in the order.

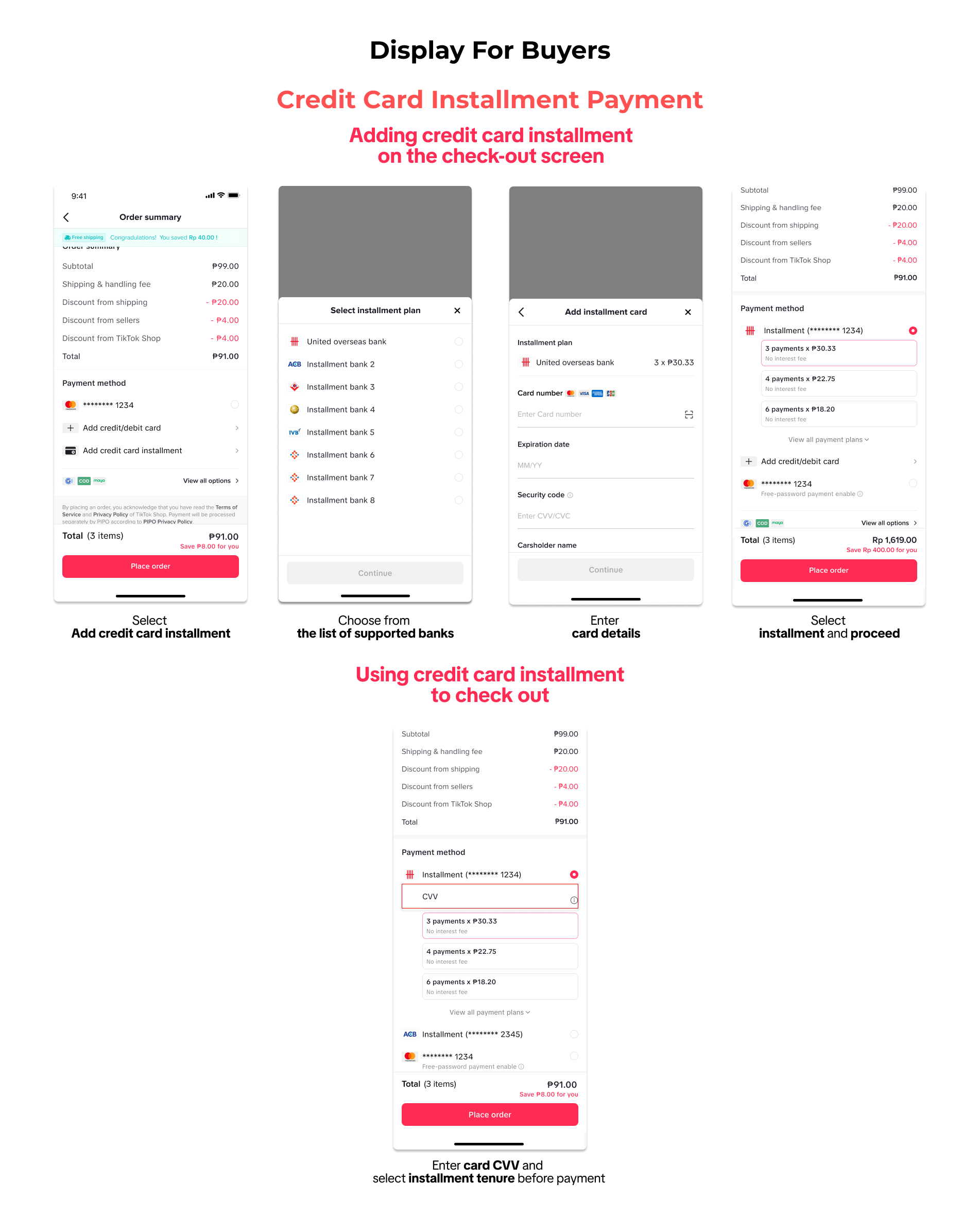

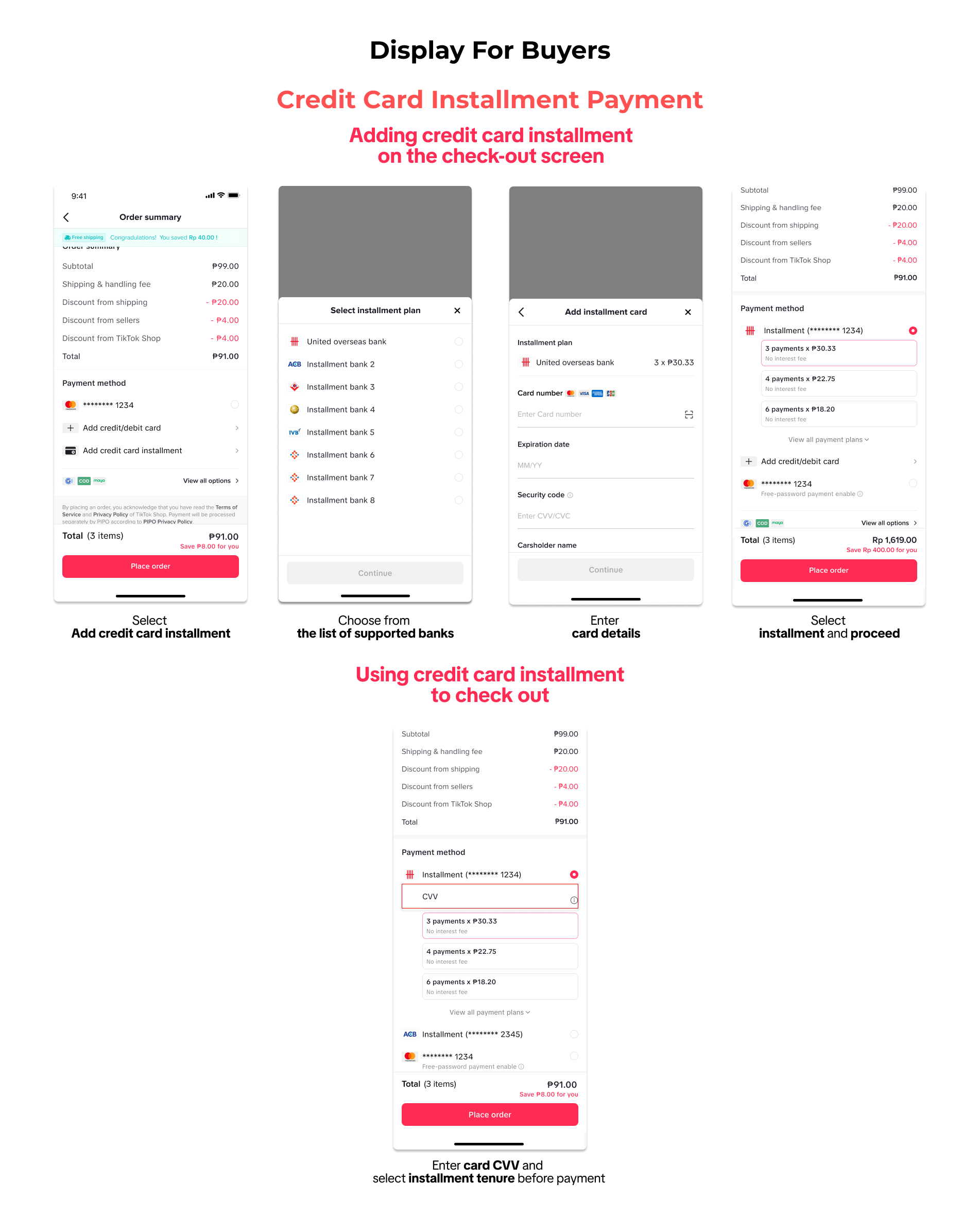

*Note: screenshots are for reference only. Actual banks, rates, data and figures differ.

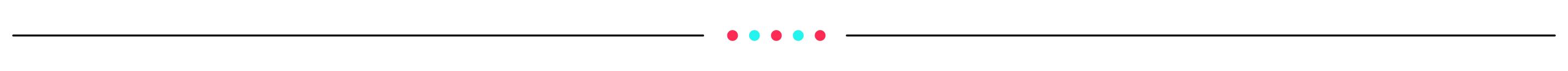

*Note: screenshots are for reference only. Actual banks, rates, data and figures differ.

If sellers are nominated, they will receive a notification on their Seller Center or via email. Three to four calendar days after notification, CC IPP with tenures of 3, 6, 9 and 12 months will be turned on to all products in their shop.

However, do note that, only orders reaching a minimum value of 3 million VND with only 1 product in the order will be payable via CC IPP.

*Note: this feature is not yet opened to all sellers.

What is Credit Card Installment Payment?

The Credit Card Installment Payment Plan (CC IPP) is an option of payment that is offered to all customers, in order to facilitate their needs to split high-value orders into more manageable monthly payments. Through this initiative, the platform aims to help sellers meet the needs of more customers and improve conversion rate, especially for high-value orders.Banks that support CC IPP on TikTok Shop are: Shinhan bank, Standard Chartered, Techcombank, HSBC, ACB, TPBank, BIDV, Eximbank, MSB, Nam A Bank, OCB, SCB, SeABank, SHB, HDBank, PVcomBank.

Customers can see CC IPP and the selected tenures when their order reaches a minimum value of VND 3.000.000 and there is only one product in the order.

How customers see CC IPP

Customers will see the CC IPP option when their orders reach the minimum required value of VND 3 million and there is only one product in the order. *Note: screenshots are for reference only. Actual banks, rates, data and figures differ.

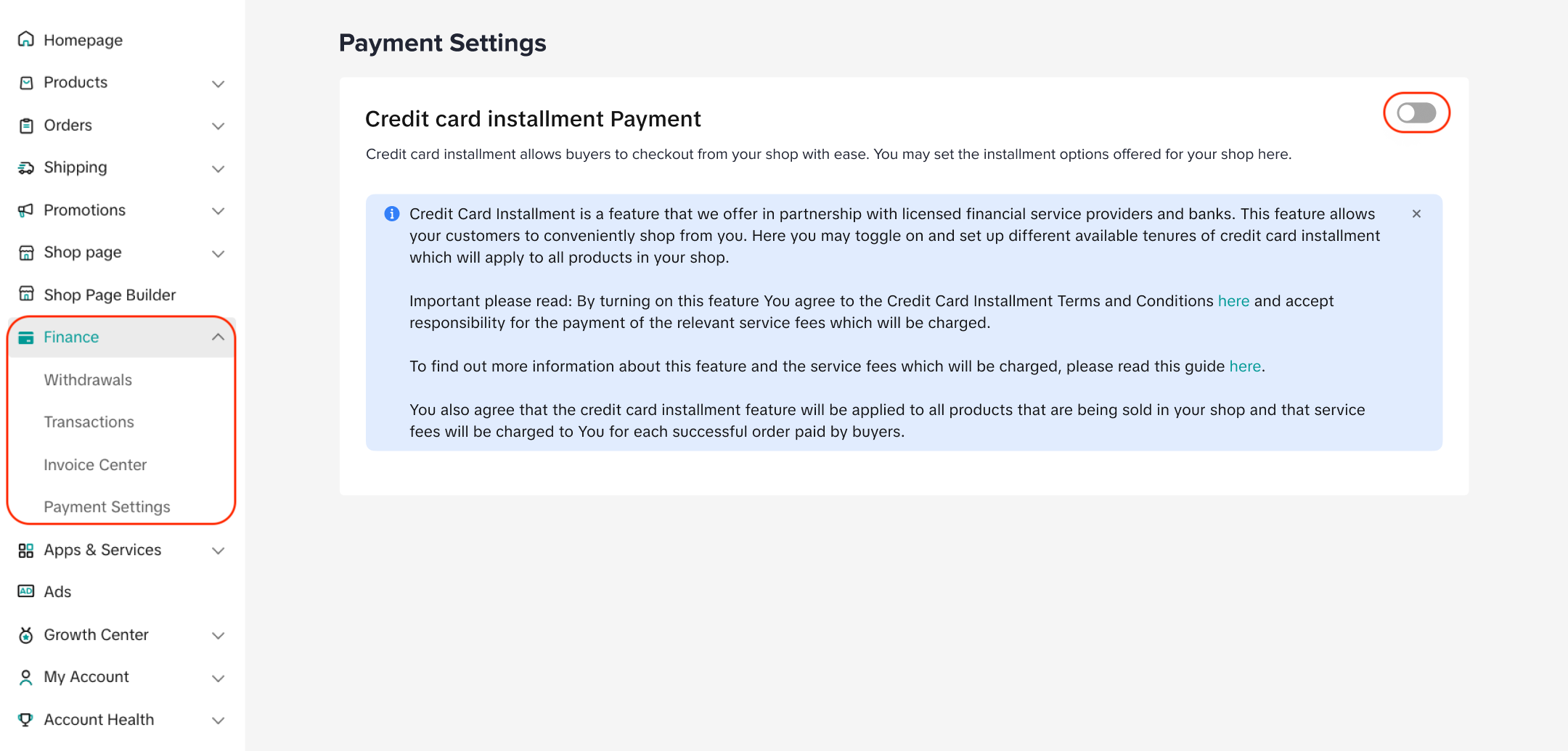

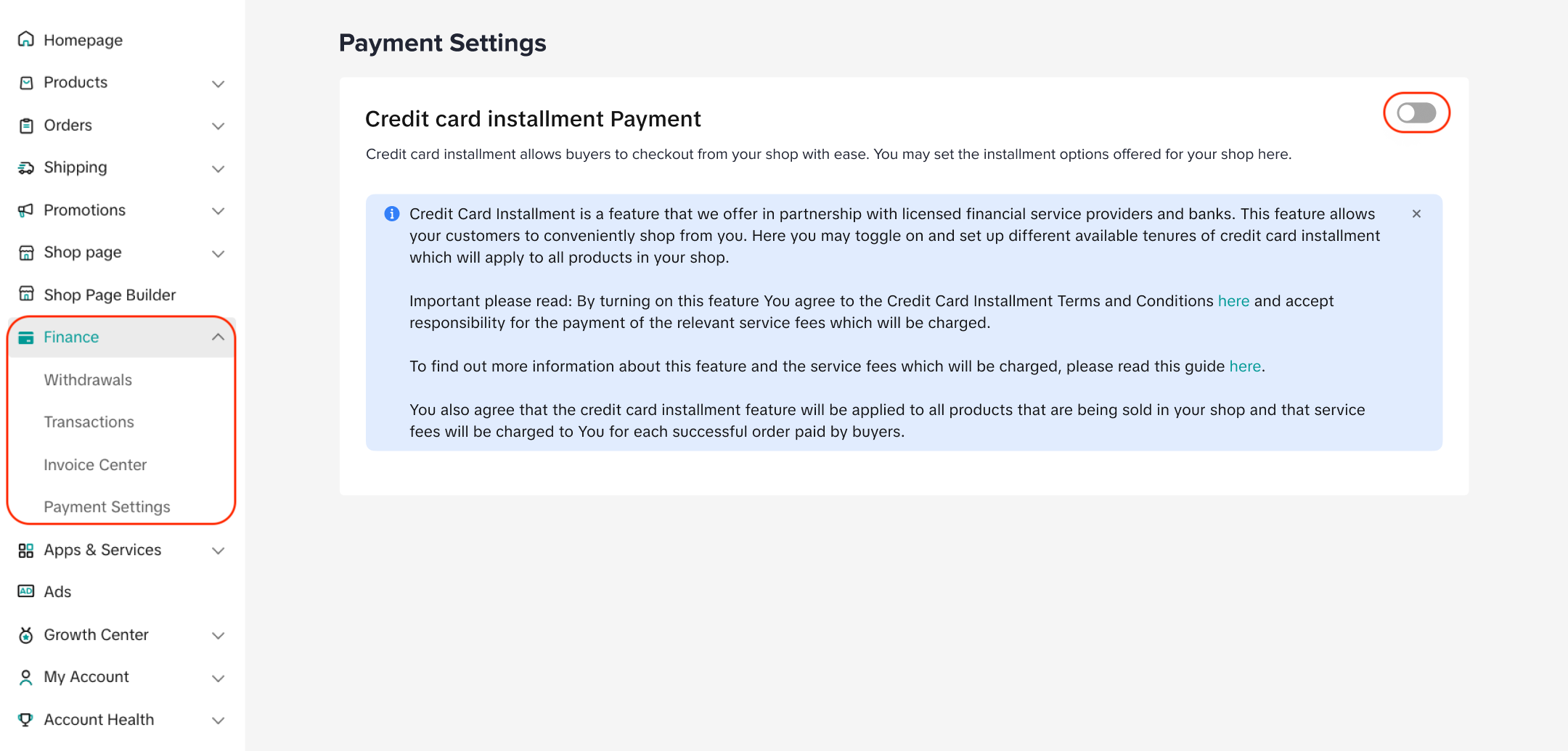

*Note: screenshots are for reference only. Actual banks, rates, data and figures differ.How Sellers Opt in for CC IPP

CC IPP is only open to selected nominated sellers.If sellers are nominated, they will receive a notification on their Seller Center or via email. Three to four calendar days after notification, CC IPP with tenures of 3, 6, 9 and 12 months will be turned on to all products in their shop.

Fees for Credit Card Installment

There are currently no additional fees for Sellers who enable CC IPP. However, orders paid via CC IPP, like all orders, are subject to the marketplace commission fee and transaction fee. Learn more here.

FAQ

- If the customers pay in installments, will the order also be settled to sellers in installments?

- What is the refund process for orders paid via CC IPP for customers?

- For full refunds, any remaining installments will be cancelled, and customers will receive the paid amount to the credit card with which they made their payment.

- For partial refunds, remaining installments will not be cancelled. Customers will be prompted to choose a bank account, where they will receive the partial refunds that they requested.

- Can sellers opt out of CC IPP?

- Can CC IPP be configured not for the whole store, but only for selected products?

However, do note that, only orders reaching a minimum value of 3 million VND with only 1 product in the order will be payable via CC IPP.

- What happens if the seller turns off CC IPP while the customer is in the process of placing an order, having already selected the installment payment option?

- If the customer is still on the payment confirmation page, the customer can still proceed with installment payments, even if the seller has turned off this option.

- If the customer exits the payment confirmation page and returns to make the payment again, the installment payment option will no longer be available to the customer until the seller turns CC IPP back on.