Withholding Taxes for Individual and Business Household Sellers

06/20/2025

According to Law No.56/2024/QH15 by the Vietnam National Party Congress on tax management and Decree No.117/2025/ND-CP by Government of Vietnam, effective from July 1st, 2025, e-commerce platforms are responsible for withholding, declaring and remitting taxes for Individual and Business Household Sellers on the platform.

To ensure correct withholding, declaration and remittance of taxes, sellers must provide accurate business information, including legal name, 12-digit identity number and business type. Personal identification number is provided during account creation.

Important notes

Example

Note: screenshots are only mockups for reference. Actual rates differ.

Note: screenshots are only mockups for reference. Actual rates differ. TikTok cannot advise you on tax matters. For further questions on tax issues, please consult your tax advisor, Tax Authority help center services, or visit the Vietnam Tax Authority website.

TikTok cannot advise you on tax matters. For further questions on tax issues, please consult your tax advisor, Tax Authority help center services, or visit the Vietnam Tax Authority website.

What are Withholding Taxes for Individual and Business Household Sellers?

Within the scope of this article, and according to Law No.56/2024/QH15 and Decree No.117/2025/ND-CP on tax management, withholding taxes for Individual and Business Household Sellers include:- Value-added tax (VAT) on goods on TikTok Shop.

- Personal income tax (PIT) on the earnings from selling goods on TikTok Shop.

To ensure correct withholding, declaration and remittance of taxes, sellers must provide accurate business information, including legal name, 12-digit identity number and business type. Personal identification number is provided during account creation.

Important notes

- Sellers are fully responsible for the accuracy of the personal identification information they provide to the platform. TikTok Shop will not refund or offset the deducted tax amount in case the seller provides incorrect information. Any updates on information will be applied from the time of recording the change of information

- If sellers do not provide sufficient/valid personal identification information, the platform is still required to withhold sellers' VAT and PIT. In this case, VAT and PIT will be declared and remitted on a no-name basis, and the platform will not be able to provide a withholding tax certificate to sellers on annual basis. Therefore, it is of sellers' interest and responsibility to provide sufficient and valid personal identification information.

- Sellers are fully responsible for VAT and PIT declaration and remittance up to Jul 1st, 2025.

- Sellers are fully responsible for their tax liabilities (if any). TikTok Shop can only withhold, declare and remit sellers' VAT and PIT for the transactions on the TikTok Shop platform based on the information provided by the sellers ; and the withholding, declaration and remittance of taxes by TikTok Shop on behalf of sellers do not eliminate sellers' responsibility to comply with Vietnam tax regulations in general.

How are the Withholding Taxes Calculated

Under the guidance in Decree No.117/2025/ND-CP, taxable revenue of each transaction of selling goods and providing services is the value of goods and services sold by business households and individuals that are entitled to be collected by the e-commerce platform management organization.Example

Original Price | VND 10,000 |

(-) Seller Discount | VND 1,000 |

VAT rate | 1% |

PIT rate | 0.5% |

Withheld VAT amount | (VND 10,000 - VND 1,000) * 1% = VND 90 |

Withheld PIT amount | (VND 10,000 - VND 1,000) * 0.5% = VND 45 |

Seller's net-tax amount | VND 10,000 - VND 1,000 - VND 90 - VND 45 = VND 8865 |

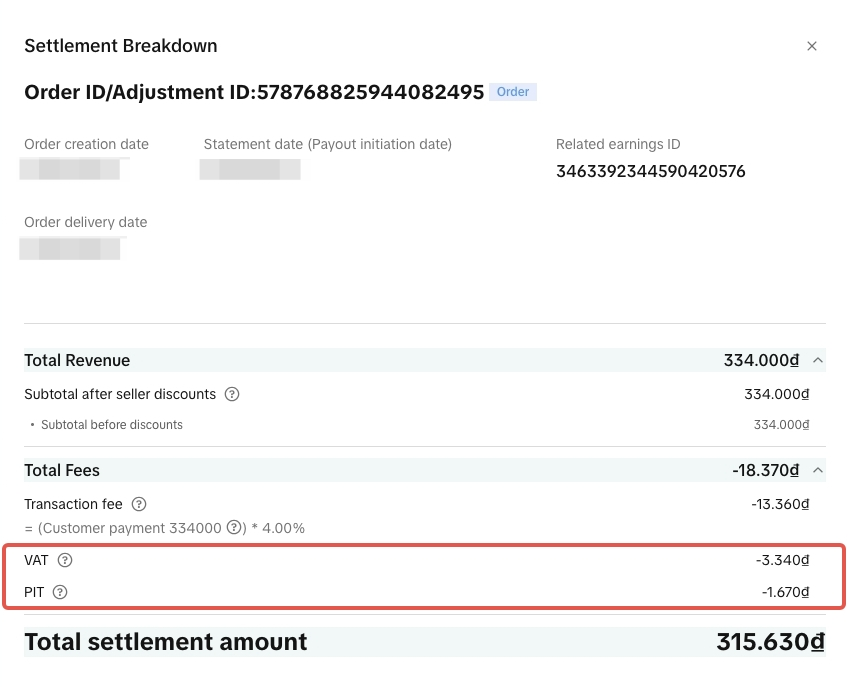

Where can Sellers check details of the Withholding Taxes?

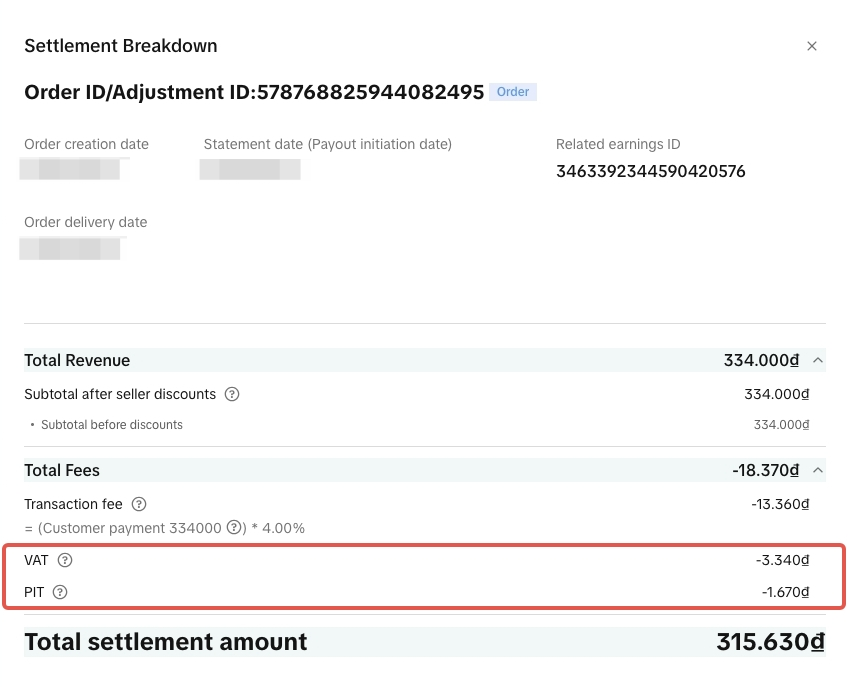

Sellers may find details of the amount of VAT and PIT withheld by TikTok Shop under the "Fees" section in their financial statements. Note: screenshots are only mockups for reference. Actual rates differ.

Note: screenshots are only mockups for reference. Actual rates differ. TikTok cannot advise you on tax matters. For further questions on tax issues, please consult your tax advisor, Tax Authority help center services, or visit the Vietnam Tax Authority website.

TikTok cannot advise you on tax matters. For further questions on tax issues, please consult your tax advisor, Tax Authority help center services, or visit the Vietnam Tax Authority website.