Tax Code Submission

08/11/2025

In accordance with the Protection of Consumers' Rights (LPCR) in Vietnam and relevant regulations, e-commerce platforms are required to collect and verify sellers' tax codes. You are hence required to submit your Tax Code via the TikTok Shop Seller Center. Please refer to this article for details on how to submit your tax codes.

All tax information must be accurate, complete, up-to-date, and match all information that has been submitted to TikTok Shop.

If I do not have a Tax Code, how can I register for one?

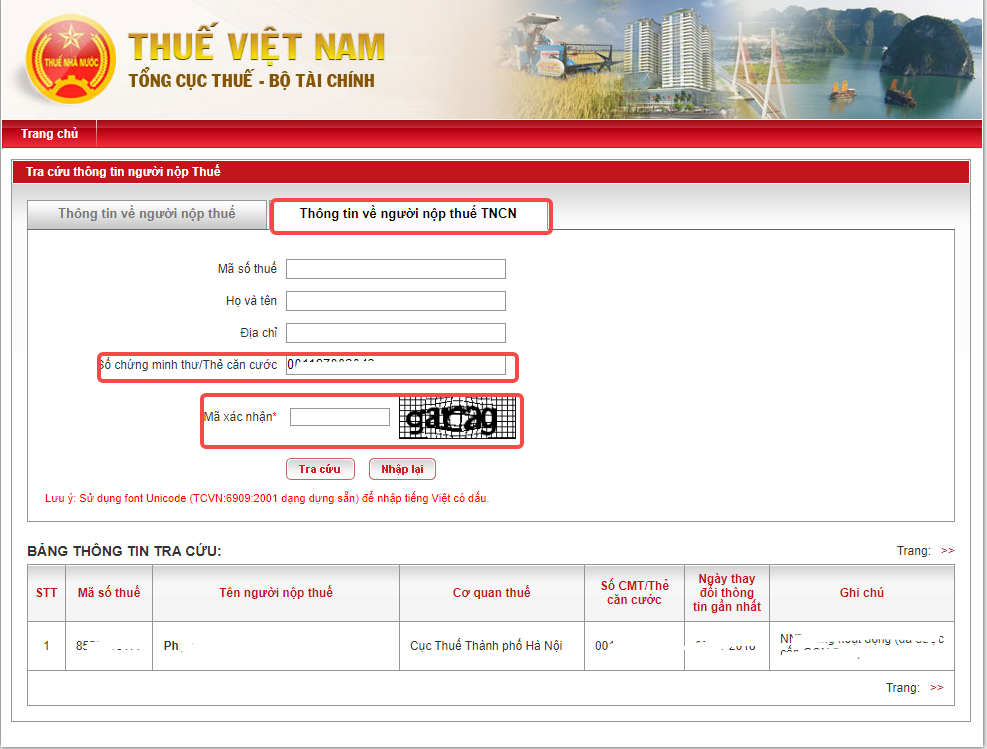

- You may do so via the online tax code registration website

- Please refer to these instructions or refer to this video for more details

Where should I submit my tax code?

Sellers can submit their tax code via the Tax Information Page on the Seller Center. Please refer to this article for details. Do note the following will occur upon submission:- Account balance withdrawals may be restricted for up to 5 business days while we verify the validity of your Tax Code.

- Your tax calculation logic may change. Please refer to this article for more information.

If you have multiple accounts, you may submit the same tax code as long as all accounts are registered to the same tax code owner. However, if accounts are registered under different individuals (such as household members, relatives or employees), different tax codes must be submitted.

What happens if I do not submit my tax code for verification?

Sellers who do not submit their tax codes for verification may be subject to enforcement actions in accordance to our Seller Terms of Service and TikTok Shop Seller Performance Evaluation Policy.Does submitting my Tax Code fulfil my tax obligations?

Tax Code submission to us does not replace your obligations to tax authorities. Please fulfill your tax obligations in accordance with the prevailing regulations. We encourage you to consult your tax advisor and/ or contact tax authorities for advice on taxation-related matters.My tax code was verified before. Why do I need to resubmit it?

Your tax code may have been found to be invalid or inaccurate. Please ensure that the tax code you have previously submitted is up-to-date, valid and accurate.What are some common reasons my Tax Code submission may be rejected?

Tax Code information does not match Account Type

You must ensure that your tax code type matches your account type.- If your TikTok Shop account was registered as an Individual Seller or Business household:

- Submit 12 Digit ID Number of the owner according to current regulation

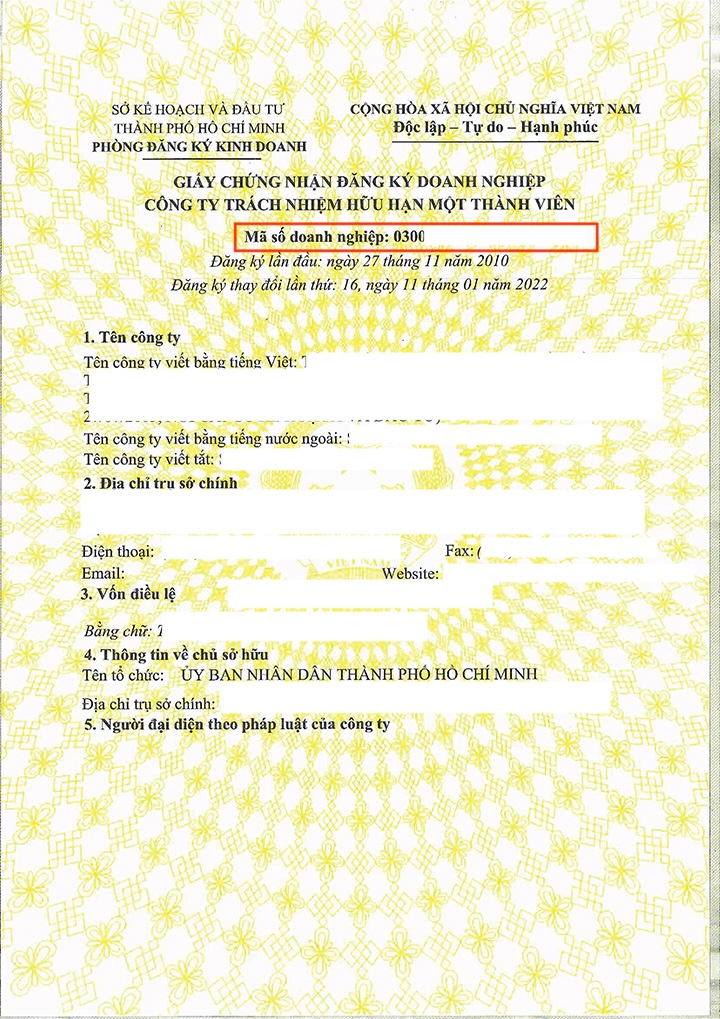

- If your TikTok Shop account was registered as a Corporate Seller:

- Submit a 10-digit or 13-digit corporate tax code. The Business Registration Number on Business Certificate is the corporate tax code (10-13 digit number with a dash).

Tax Code information on Government website does not match TikTok Shop Account Information

- Ensure that the tax code is registered to the same individual/company as the TikTok Shop account. All information must be an exact match.

- Please ensure that there are no spelling errors and the language used is the same (e.g. If English is used for the Tax Code, the information on TikTok Shop must also be in English instead of Vietnamese).

- Please also ensure that all information is also written fully or abbreviated in a consistent manner.

- If the information on your TikTok Shop Account requires updating to match your Tax Code Information, please do so via the Seller Qualification Center. For more information, please click here.

Tax Code is inactive/invalid

Ensure that the tax code has not expired.Tax Code can not be found on the official tax database

Ensure that the tax code can be found on the official tax website.You may also be interested in

How To Register a TikTok Shop Account In Vietnam – Step-by-S…

I. Introduction TikTok Shop is a direct selling platform integrated within TikTok, allowing sellers…

OPERATIONAL FEE ON TIKTOK SHOP

Shop Official Account

About Shop Official Account The TikTok account that represents the official identity of TikTok Shop…

Seller Registration

Registration process in TikTok Shop is very convenient. You can sign up with your existing TikTok ac…

Adjustment Period for New Shops

New shops are subject to a adjustment period during which some functions are restricted. These restr…

Registration Process - Individual Sellers

Eligibility TikTok Shop only allows citizens of Vietnam to register as individual sellers. Applicant…

TikTok Shop Mall Qualification

What is TikTok Shop Mall TikTok Shop Mall is a virtual shopping mall that features a curated selecti…

Registration Process - Corporate Sellers

Eligibility TikTok Shop only allows entities incorporated or registered in Vietnam to register as co…

Registering to be a Seller

Your seller journey with TikTok Shop begins with account registration. You can register as either a…