How to Declare Affiliate Spending on TikTok Shop as Company Expense

12/22/2023

How to Declare Affiliate Spending on TikTok Shop as Company Spending

- Copy of the service agreement;

- Evidence of payment to Creators ( TikTok Shop Affiliate Commission Invoice )

- Evidence of 10% PIT declaration and payment (e.g. tax returns or tax payment slip).

How to Download Affiliate

Under TikTok Shop Seller Center > Finance > Invoice Center, there are 3 categories:

- All invoices

- Platform service fee - issued by TikTok Shop

- Affiliate commission

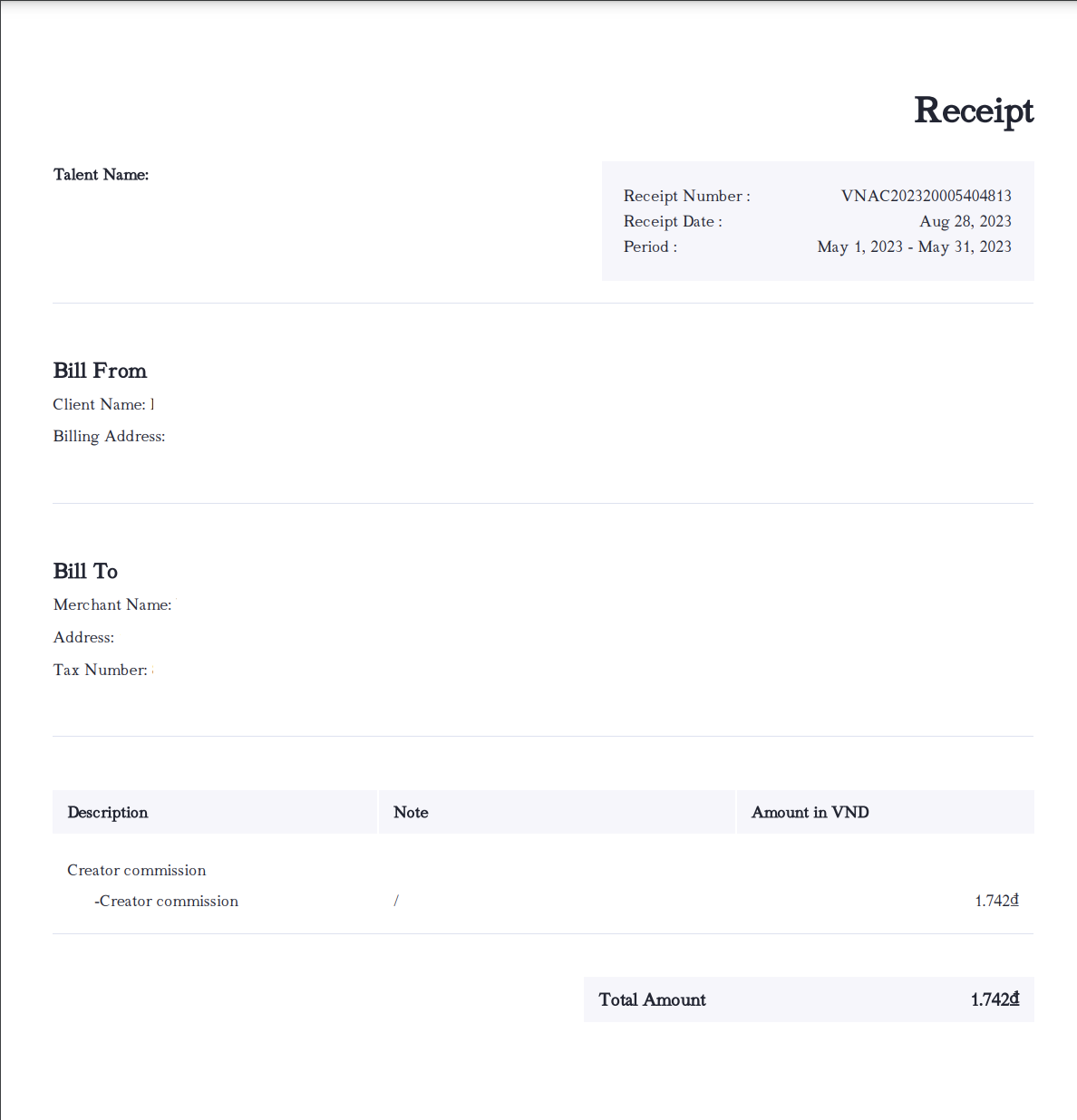

Sample of Affiliate commission Invoice: